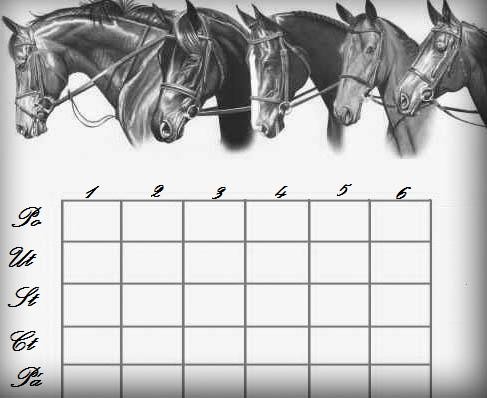

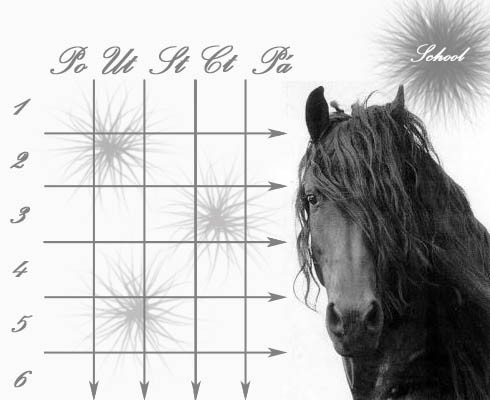

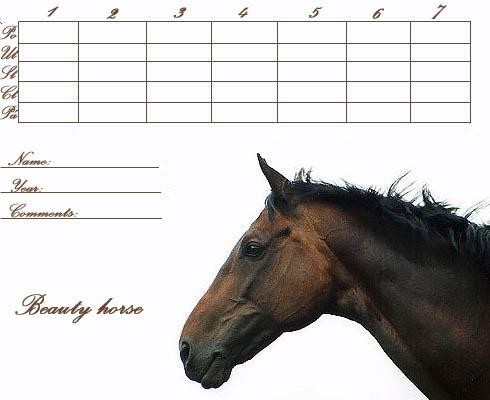

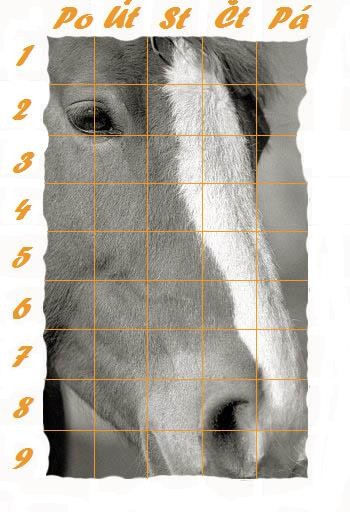

Rozvrhy hodin s koňmi

Tak jsem vyráběla a vyráběla rozvrhy s koňma,nejsem žádnej profík,takže doufám že se budou líbit :)

Ale všechny jsou prosím (c) takže jen pro vlastní potřebu!!!

Doporučuju doplnit si hodiny na PC třeba ve Photofiltre nebo v Photoshopu,ale jde to tam dopsat i ručně :)

Dik :*

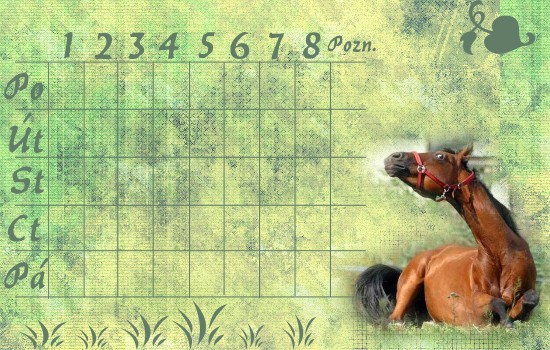

Tak tenhle mi dal dost zabrat,doufám že se líbí :)

Takový letní,s krásným koníkem :P

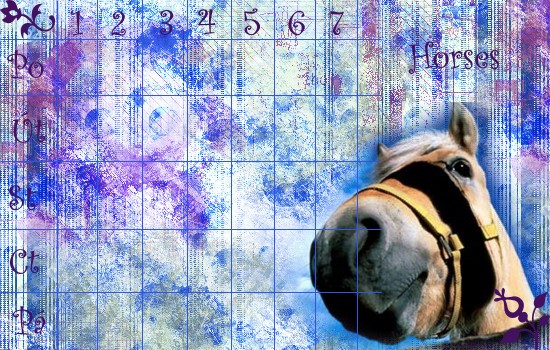

Krásnej čumáček,musel být využit... :D

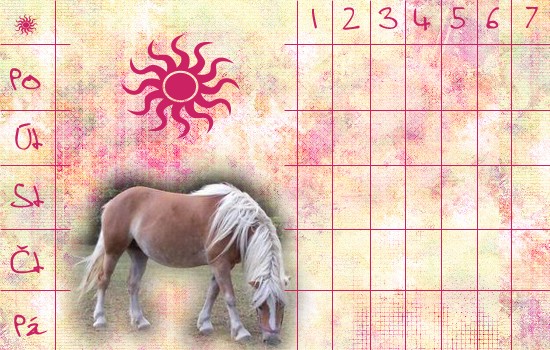

Růžovoučkej pro barbínky :P

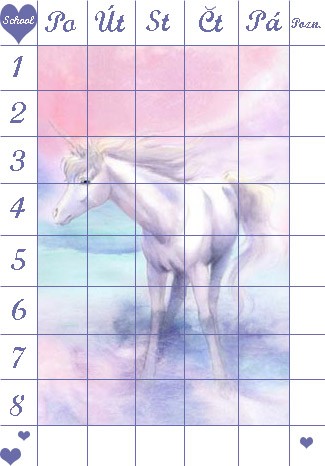

Podle mě nejpovedenější,zvláštní a elegantní :)

Pro milovníky appaloos :)

Frísáky žerou všichni :D

Tady jeden pro malé slečny :P

Jeden z těch elegantnějších a pracnějších :)

*klapka*

Frísák podruhé!!!

Jednoduchý,elegantní,praktický :P

Jednoduchý,pro ty co mají hodně hodin

Jeden z pracnějších ale povedených :)

Na další dva rozvrhy jsou odkazy,protože se sem nevejdou,pardon... :)

Tak tenhle se mi děsně líbí,ten koník je boží

Obyčejný a praktický rozvrh s malým koníkem

Pro westerňáky a Barču :P

Parkurový rozvrh pro milovníky tohoto sportu :D

Zelený a přírodní...

Elegantní s oblíbenýma fotkama ;)

S krásným andalusanem

Golfík

Komentáře

Přehled komentářů

Wygrywaj z 21 w blackjacku, tworz zwycieskie uklady w pokerze, stawiaj zaklady w kasynie na zywo i baw sie przy najlepszych grach online w kasynie na zywo https://grakasynonazywo.pl/

Gra w Ruletke Online w Najlepszych Kasyno w Polsce

(Horaciowhize, 15. 8. 2024 12:59)Klasyczna gra kazdego kasyna, ktora w pelni oddaje atmosfere ryzyka, to bez watpienia ruletka online w kasynie https://ruletkagra.pl/

Nowe Online Kasyna z Darmowymi Spinami Bez Depozytu

(TimothyPat, 15. 8. 2024 2:03)Program bonusowy kazdego nowego kasyna online w Polsce obejmuje roznorodne promocje https://kasynadarmowespiny.pl/

Nowe Online Kasyna z Darmowymi Spinami Bez Depozytu

(TimothyPat, 15. 8. 2024 1:38)Program bonusowy kazdego nowego kasyna online w Polsce obejmuje roznorodne promocje https://kasynadarmowespiny.pl/

Gra Automatow Kasynowe na Pieniadze

(Henryvar, 15. 8. 2024 0:58)W swiecie hazardu w Polsce kasyna online zajmuja szczegolne miejsce, oferujac wygodna mozliwosc przetestowania swojego szczescia i wygrania bez wychodzenia z domu https://grykasynonline.pl/

Nowe Kasyna z Bonusem Bez Depozytu

(ErickPlorp, 15. 8. 2024 0:47)Bonus bez depozytu w kasynie to mozliwosc gry w gry kasynowe na prawdziwe pieniadze bez koniecznosci wplacania srodkow na konto https://kasynazbezdepozytu.pl/

Gra Automatow Kasynowe na Pieniadze

(Henryvar, 14. 8. 2024 23:48)W swiecie hazardu w Polsce kasyna online zajmuja szczegolne miejsce, oferujac wygodna mozliwosc przetestowania swojego szczescia i wygrania bez wychodzenia z domu https://grykasynonline.pl/

Nowe Kasyna z Bonusem Bez Depozytu

(ErickPlorp, 14. 8. 2024 22:13)Bonus bez depozytu w kasynie to mozliwosc gry w gry kasynowe na prawdziwe pieniadze bez koniecznosci wplacania srodkow na konto https://kasynazbezdepozytu.pl/

Licensed slot machines on onlinecasino

(Jekpeext, 14. 8. 2024 10:34)

https://kometa-slots.ru

Start winning today, get a no deposit gift or free spins of your choice. Only the top best bonuses!

Emprender como crear

(Manuelguips, 14. 8. 2024 3:03)https://www.cosmopolitan.com/es/moda/consejos-moda/a35634628/emprender-como-crear-tu-negocio-marca-moda/

Emprender como crear

(Manuelguips, 14. 8. 2024 2:46)https://www.cosmopolitan.com/es/moda/consejos-moda/a35634628/emprender-como-crear-tu-negocio-marca-moda/

Get big b...

(NgcExcum, 13. 8. 2024 22:37)

Top сasіnоs

200% deposite bonus and 250 freespin

Gеt уоur sіgn-up bоnus

https://tinyurl.com/4y39sa7r

TorZon darknet site

(ThomasVag, 13. 8. 2024 3:10)

TorZon Market - best darknet shop https://customketodiet.myfairreviews.com/unlock-torzon-markets-newest-secure-url-for-seamless-access-today

New vending machines on onlinecasino

(Jekpeext, 12. 8. 2024 16:21)

https://uzhnybriz.ru

Start winning today, get a no deposit gift or free spins of your choice. Only the top best bonuses!

Transunion Says I’m Deceased

(Arthurdeest, 10. 8. 2024 6:50)

Has it ever happened that your credit report unexpectedly “declares” you dead? Encountering an erroneous death marker in your TransUnion credit report can be a significant ordeal for anyone. This mistake not only creates a sense of anxiety and stress but can also have long-term consequences for your financial life, affecting your ability to obtain loans, insurance, and even employment.

Comprehending the Gravity of the Situation

The erroneous listing of you as deceased in TransUnion’s databases is not just a small oversight. It’s a mistake that can block your access to the most critical financial tools and services. It’s crucial to realize that behind this “digital” problem lie real-life inconveniences and obstacles, such as issues with the social security administration death index and wrongful denial of coverage.

Statistical Insight

Let’s consider some statistics that illustrate the prevalence of the problem. For instance, credit bureau reports deceased and social security administration death notification errors occur frequently. Experian death notification and Equifax death notice errors are also common.

These figures underscore the importance of timely detecting and correcting such errors. If you find your credit report says I am deceased or your credit report shows deceased, immediate action is required.

Advantages of Turning to Our Law Firm

Choosing our company to solve your problem with your credit report is a choice in favor of professionalism and reliability. Thanks to deep knowledge of the FCRA law and experience in handling similar cases, we offer you the following benefits:

Guarantee of no expenses on your part: the costs of our services are borne by the respondent.

Numerous satisfied clients and substantial compensations confirm our effectiveness.

Full service from interacting with credit bureaus to protecting your interests.

Examples of Problems Faced by People

Mistakenly reported as deceased TransUnion – denials of credit and financial services.

Credit report is showing deceased TransUnion – problems with insurance applications and insurance company refusal to pay.

Flagging TransUnion account as deceased – difficulties with employment due to background check errors.

TransUnion deceased alert – inability to sign financial contracts, leading to insurance claim denial and long-term care claim lawyer consultations.

These issues not only create financial and emotional difficulties but also undermine your trust in the credit monitoring system. When errors like a deceased indicator on credit report occur, it's essential to have an experienced insurance attorney on your side to navigate the complexities.

Have you been mistakenly reported as deceased on credit report? Are you dealing with a social security number reported as deceased or credit report deceased errors? Our firm specializes in resolving these issues, ensuring your records are corrected swiftly. Contact us to enforce insurance promises and get your financial life back on track.

If your credit report says I am deceased, don't wait. Our experienced team can help you prove you are not deceased and address inaccuracies such as deceased indicator meaning and credit bureau reports deceased. Trust us to handle your case with the dedication of a skilled insurance lawyer.

https://bucceri-pincus.com/emily-islada-cus/

Jackpot Bet Online

(Sidneykal, 8. 8. 2024 12:41)

We bring you latest Gambling News, Casino Bonuses and offers from Top Operators, Online Casino Slots Tips, Sports Betting Tips, odds etc.

https://www.jackpotbetonline.com/

How To Alliant Credit Union In A Slow Economy

(Riannsew, 7. 8. 2024 2:16)

It's a shame you don't have a donate button! I'd certainly donate to this outstanding blog! I guess for now i'll settle for bookmarking and adding your RSS feed to my Google account. I look forward to fresh updates and will share this site with my Facebook group. Talk soon!

see also my page

https://another-ro.com/forum/viewtopic.php?id=480367 - Alliant CU login

https://nanasnichoir.com/community/profile/maggiehale43977/ - Alliant CU login

https://another-ro.com/forum/viewtopic.php?id=476548 - Alliant CU login

https://vortexsourcing.com/alliant-credit-union-your-business-in-15-minutes-flat/ -alliantcu

watch

(Tik2thydop, 6. 8. 2024 13:21)

Initiate an exhilarating journey to experience a world of provocative content with our extensive collection of exclusive adult sites. Submerge in a dimension where dreams know no bounds.

Savor a rich spectrum of styles, satisfying every inclination. From soft romance to steamy encounters, our options span the entire range of adult entertainment.

Investigate special categories and uncover what truly turns you on. Our seamless interface makes it uncomplicated to track down your dream content.

Encontre a melhor maneira de saber

(BrianBoige, 30. 7. 2024 18:08)Encontre a melhor maneira de saber a hora exata no Brasil no site horasbrazil2.top. Nao importa em qual fuso horario voce esteja, nosso site fornece as informacoes mais atuais e precisas sobre o horario. Interface amigavel, acesso rapido e dados exatos - tudo o que voce precisa para estar sempre atualizado. Visite-nos e comprove https://horasbrazil2.top

1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 | 60 | 61 | 62 | 63

Gry na Zywo w Internetowym Kasyno

(Robertzib, 15. 8. 2024 20:00)